Hartford Office

75 Charter Oak Avenue

Suite 1-103

Hartford, CT 06106

Stamford Office

700 Canal Street

5th Floor

Stamford, CT 06902

© 2023 CT Green Bank. All Rights Reserved.

The Green Bank offers solutions for commercial buildings of all types to access green upgrades to new and existing buildings. More modern, sustainable buildings help owners save money, reduce their environmental impact, and create better spaces for their tenants, employees, and residents.

The Green Bank offers solutions for commercial buildings of all types to access green upgrades to new and existing buildings. More modern, sustainable buildings help owners save money, reduce their environmental impact, and create better spaces for their tenants, employees, and residents.

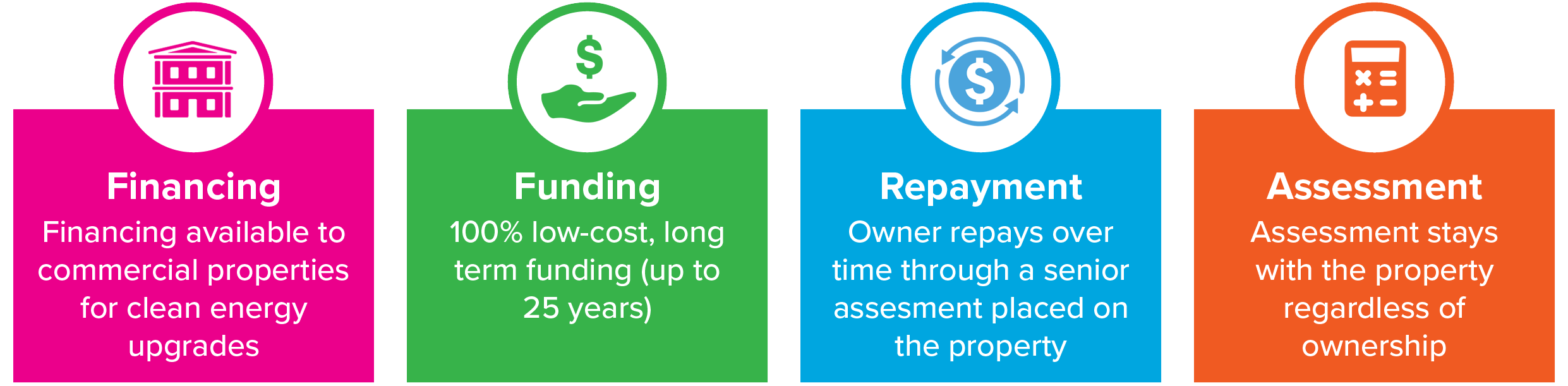

The Green Bank offers solutions for commercial buildings of all types to access green upgrades to new and existing buildings. More modern, sustainable buildings help owners save money, reduce their environmental impact, and create better spaces for their tenants, employees, and residents. Low cost, long term financing is repaid by the property owner over time through an assessment that is placed on the property.

All types of commercial properties can use C-PACE (Commercial Property Assessed Clean Energy) for all types of green upgrades to new and existing buildings. Higher performing buildings are made possible thanks to an experienced contractor network and access to attractive financing repaid through a simple and secure repayment mechanism. Learn more about how the Green Bank makes C-PACE possible for retrofit and new construction projects.

C-PACE works for nearly any type of commercial property in municipalities that participate in C-PACE. Manufacturing facilities, offices, retail establishments, houses of worship, nonprofits, and other buildings can all benefit from energy efficiency and clean energy updates through C-PACE.

Increase your building’s value and comfort with financing for green improvements, including energy efficiency and renewable energy.

With C-PACE new construction financing, you can access affordable, long-term financing for the development of all types of properties.